The Eye Of The Tiger

I share an experimental idea today. Please consider it a call for research rather than a proven theory.

There is a very interesting chart that you get, every time you run a SurveyMonkey survey.

The chart shows an income distribution of US households with the mode being a surprising $25000-$50000 well below the actual per-capita GDP number.

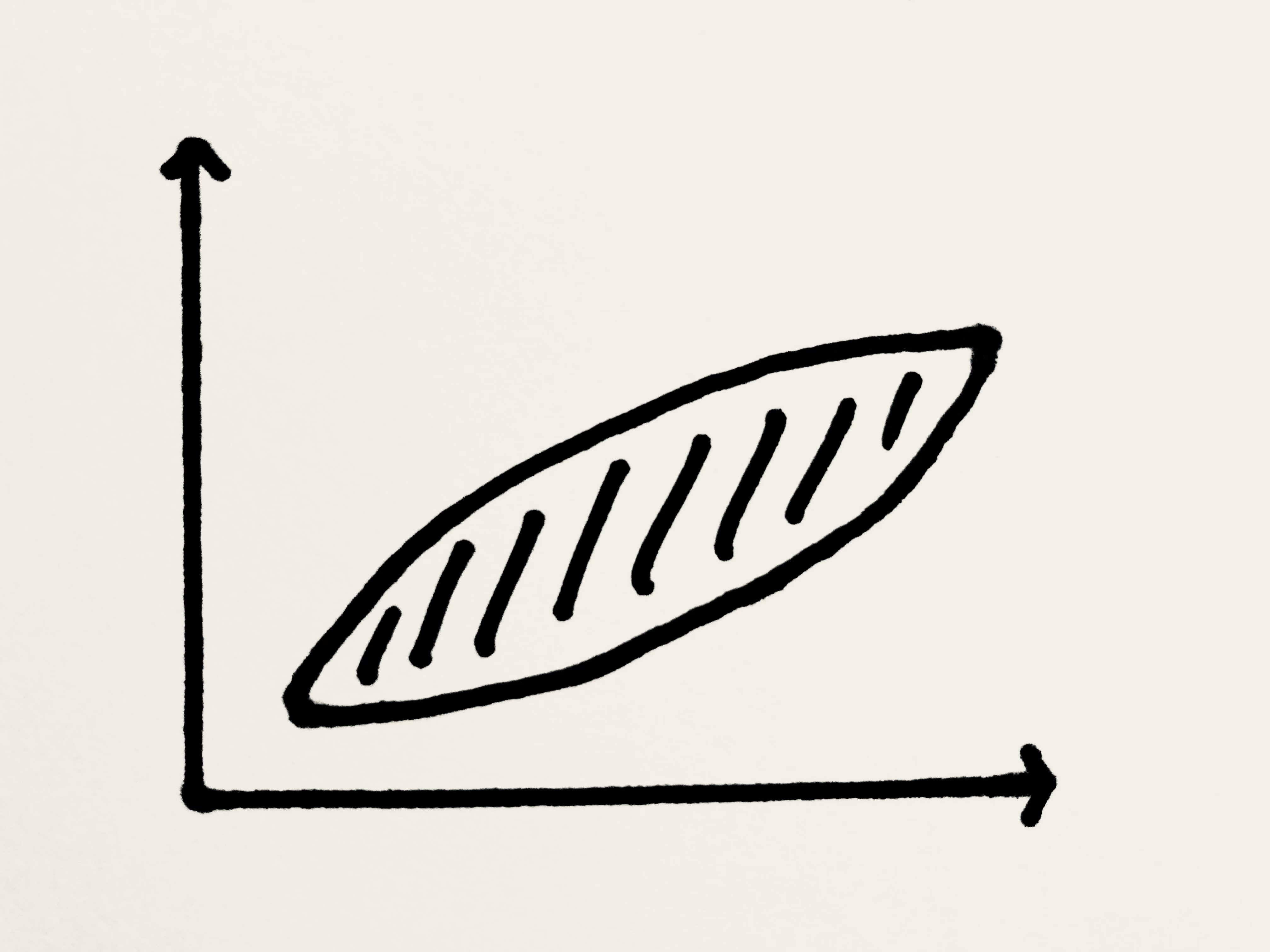

I consider it as an entrepreneur my opportunity. I am not well-connected into the current Big Tech ecosystem. If you connect the dots, it shows a slope steeper on the right at the level of earners around $200K. One would argue that the steep part should be around $20K making the chart look like an eye. This is what I call the Eye of The Tiger referring to the song. It also refers to the remarkable growth of East and South Asian countries in the 1990s and 2000s. Please refer to the illustration at the end of this paper.

Copyright© Miklos Szegedi, dr., circa. 1977.

There are of course other reasons as well. GDP includes government spending, net investment, and net foreign trade. The latter is negative partly due to trade to East Asia.

However, who does not want to live at a level of the $200K earners?

There are arguments pro and contra.

The Eye Of The Tiger is a potential growth opportunity. Guess, what, it only needs investment of new housing, new offices, new airplanes, new cargo ships. You do not even really need much innovation. You just copy what is already there. I hear what you say. “Does not Tesla do the same already?” Yes, they do.

There are environmental concerns of course with more spent on travel for example. It is a carbon risk.

Also, many servicing industries rely on cheap labor, so you may still need to invest in more automation. Manufacturing also matters. As some manufacturing moves back to the US, there is a need for robotics, to offset the lower supply of cheap labor.

Sometimes space available is an issue, but it may not be such a big problem, if households can consume water from hydrogen, a very light material to transport. You need to be smart.

Let’s pick the median household. If the median grow themselves, you can increase the US GDP from $24T to $50T in theory. You may need two more Apples, five more Metas, ten more Amazons, twenty more Teslas. Who knows what else? It is lucrative, is not it?

Household income percentiles

Illustration | Horizontal: Percentile of Households | Vertical: income in USD | Actual Data: Household Income Percentiles

Illustration | Horizontal: Percentile of Households | Vertical: income in USD | Actual Data: Household Income Percentiles

It is a very interesting research topic to identify what brings a business from the lower $24T into the middle $24T. When the eye fills, it likely cannot rely much on existing businesses other than the growth ones like construction or equipment manufacturing.

As businesses grow, they become conservative. Many decisions support keeping the status quo. They try not to alienate existing customers. There is a crowding effect lowering efficiency that deters growth opportunities.

New businesses may not find leads, or they may have a hardship to leverage their leads. A typical conversation across the lower line probably looks like this:

- A company contacts a potential buyer.

- The buyer already works with a similar solution, that is not perfect but good enough.

- There is no trust between established and new businesses.

- The company is reluctant to lower prices accepting a less lucrative customer base.

Will this happen? Probably not in our lifetime. However, there is an opportunity for businesses to grow. Inflation shook the economy. The low productivity, low GDP growth period is probably over forever.